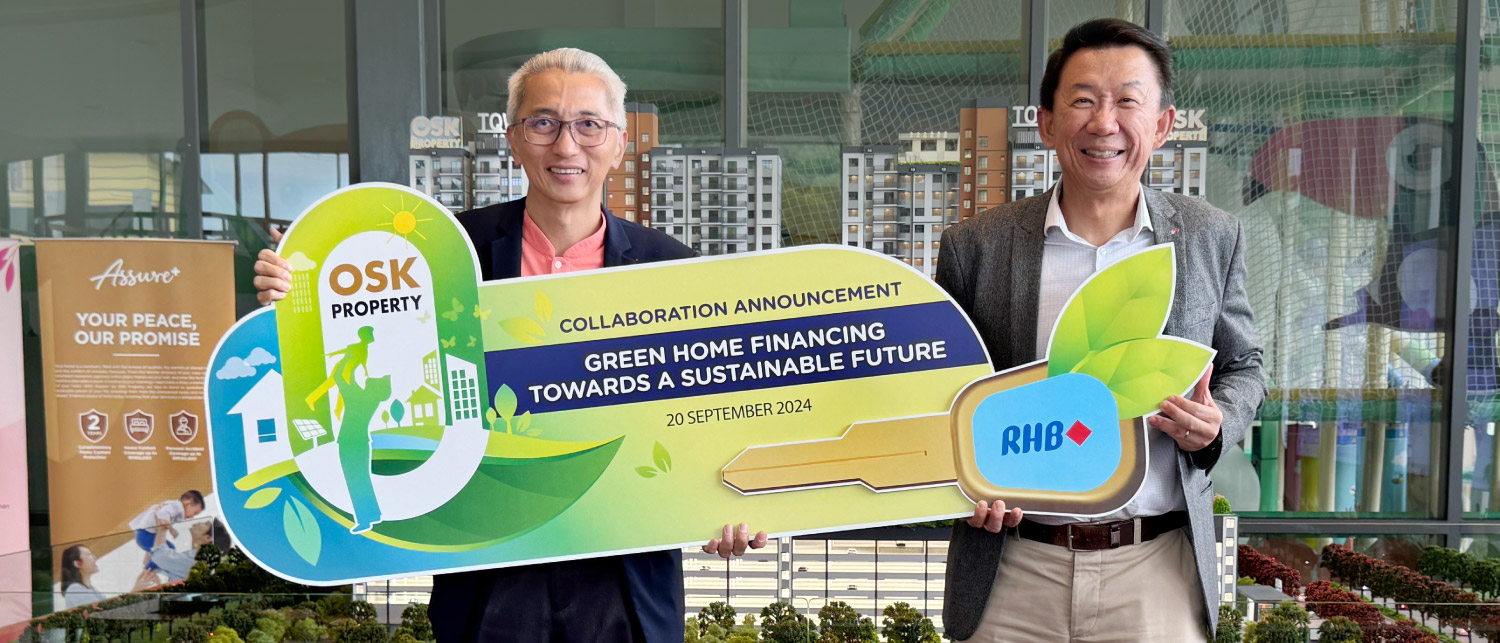

Kuala Lumpur, 20 September 2024 — RHB Bank Berhad today announced its first strategic partner, OSK Property Holdings Berhad, on launching a new green financing initiative designed to promote sustainable development in Malaysia. This initiative offers preferential mortgage rates with up to 95% + 5% margin of financing for residential projects that have achieved recognized green certifications, aligning with both companies’ commitment to Environmental, Social, and Governance (ESG) principles.

Universal Cable, currently under liquidation, will be disposing its two manufacturing plants in Tebrau and Plentong, Johor together with its land and machinery, for a total purchase consideration of RM85 million.

With this proposed acquisition, Olympic Cable is poised to expand its capabilities, particularly in the high-voltage cable segment, further solidifying its market presence in Malaysia. This move aligns with the Group’s broader vision of becoming a market leader in the cable manufacturing industry, both domestically and in key regional markets.

OSK Group Managing Director Ong Ju Yan said that the acquisition of an existing plant and its operations would accelerate the Group’s production volume and capabilities.

Through this collaboration, RHB Bank aims to support property developers who are leading the way in sustainability by providing financing solutions that encourage eco-friendly construction and design. The projects under OSK Property that are eligible for this green financing are ALIA @ Mori Park in Shah Alam and NARA at Shorea Park in Puchong. Both developments have attained GreenRE certification, ensuring that they meet stringent environmental standards and contribute to a more sustainable future.

“We are thrilled to have RHB Bank as our partner in offering green financing for our certified developments, ALIA @ Mori Park and NARA at Shorea Park. Green certification is more than just a label; it represents a commitment to building a sustainable future. By aligning our projects with green standards, we are not only enhancing the quality of life for our residents but also contributing to the global push for environmental stewardship,” said Ong Ghee Bin, Chief Executive Officer of OSK Property.

“RHB Bank is dedicated to supporting property developers who prioritise sustainability in their projects. By offering preferential mortgage rates and higher margin of financing for green-certified developments like those by OSK Property, we are making it easier for homebuyers to invest in sustainable living. This partnership reflects our broader commitment to ESG initiatives and our belief that financial institutions have a crucial role to play in driving positive environmental impact,” said Jeffrey Ng Eow Oo, Managing Director of RHB Group Community Banking.

The green financing initiative is expected to set a new benchmark for sustainable development in Malaysia, encouraging more developers to pursue green certifications for their projects. Both RHB Bank and OSK Property are confident that this collaboration will not only benefit homebuyers but also contribute significantly to the nation’s environmental goals.

For more information about the green financing initiative and eligible projects, please visit www.rhbgroup.com/greenfinancing or www.oskproperty.com.my